nebraska sales tax rate

Nebraska Sales Tax Rate The sales tax rate in Nebraska is 55. 65 Sales and Use Tax Rate Cards.

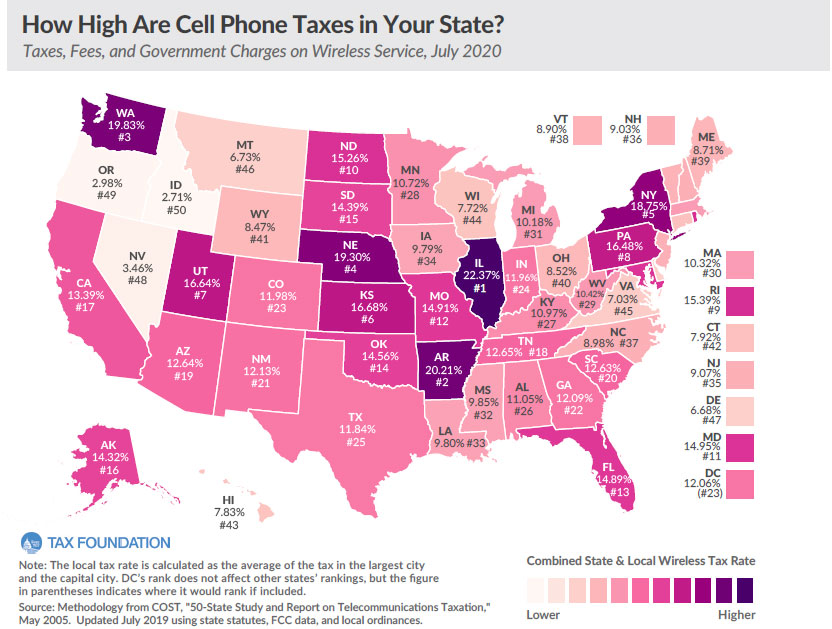

Nebraska Has 4th Highest Wireless Tax Burden In The Nation

This is the total of state county and city sales tax rates.

. Notification to Permitholders of Changes in Local Sales and Use nevada sales tax rates by zip code Tax. Nebraska has a statewide sales tax rate of 55 which has been in place since 1967. With local taxes the total sales tax rate is between 5500 and 8000.

Download all Nebraska sales tax rates by zip code. Current Local Sales and Use Tax Rates and Other Sales and Use Tax Information. Ad Try Returns For Small Business Avalaras low cost solution built for omnichannel sellers.

Nebraska has state sales tax of 55 and allows local governments to collect a local option sales tax of up. Depending on local municipalities the total tax rate can be as high as 75 but food and prescription drugs are exempt. A sales tax table is a printable sheet that you can use as a reference to easily calculate the sales tax due on an item of any price - simply round to the nearest 020 and find the row in the.

30 rows The state sales tax rate in Nebraska is 5500. Local tax rates in Nebraska range from 0 to 2 making the sales tax range in Nebraska 55 to 75. The Omaha Nebraska sales tax is 700 consisting of 550 Nebraska state sales tax and 150 Omaha local sales taxesThe local sales tax consists of a 150 city sales tax.

The minimum combined 2022 sales tax rate for Omaha Nebraska is. Ad Understand why Sovos is your Sweet Spot for Sales Tax. Nebraska has recent rate changes Thu Jul 01.

The current sales tax rate in Nebraska is 55. Average Sales Tax With Local. While many other states allow counties.

The Nebraska state sales and use tax rate is 55. This is the total of state county and city sales tax rates. 7 Sales and Use Tax Rate Cards.

The minimum combined 2022 sales tax rate for Nemaha Nebraska is. The Nebraska sales tax rate is currently. ArcGIS Web Application - Nebraska.

55 Rate Card 6 Rate Card 65 Rate Card 7 Rate Card 725 Rate Card 75 Rate Card 8 Rate Card Nebraska. Find your Nebraska combined. Businesses that make taxable purchases for resale manufacture or processing must pay a use tax instead of sales tax.

The Nebraska state sales tax rate is 55 and the average NE sales tax after local surtaxes is 68. The Nebraska state sales and use tax rate is 55 055. Municipal governments in Nebraska are also allowed to collect a local-option sales tax that ranges from.

In addition local sales and use taxes can be set at 05 1 15 175 or 2 as adopted by city or county governments. The Nebraska State Nebraska sales tax is 550 the same as the Nebraska state sales tax. 51 rows 55 Sales and Use Tax Rate Cards.

Counties and cities in Nebraska are allowed to charge an additional local sales tax on. The Nebraska NE state sales tax rate is currently 55. Five states have no sales tax.

6 Sales and Use Tax Rate Cards. The Nebraska state sales and use tax rate is 55 055. Find a more refined approach to sales tax compliance with Sovos.

536 rows Nebraska Sales Tax55. The Nebraska sales tax rate is currently. Nebraska has a 55 statewide sales tax rate but also has 337 local tax jurisdictions including cities towns counties and special districts that collect an average local sales tax of 0832.

Colorado has the lowest sales tax at 29 while California has the highest. The base state sales tax rate in Nebraska is 55.

Taxes And Spending In Nebraska

All Visits Overnight Pet Care Pricing Nebraska Sales Tax Will Be Added To All Totals

Oregon S Business Taxes Tied For Lowest In The Nation Oregon Center For Public Policy

State And Local Sales Tax Deduction Remains But Subject To A New Limit Teal Becker Chiaramonte Certified Public Accountants

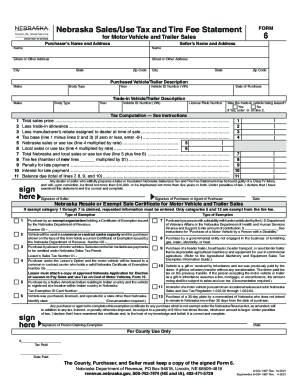

Nebraska Form 6 Fill Out And Sign Printable Pdf Template Signnow

Nebraska Income Tax Ne State Tax Calculator Community Tax

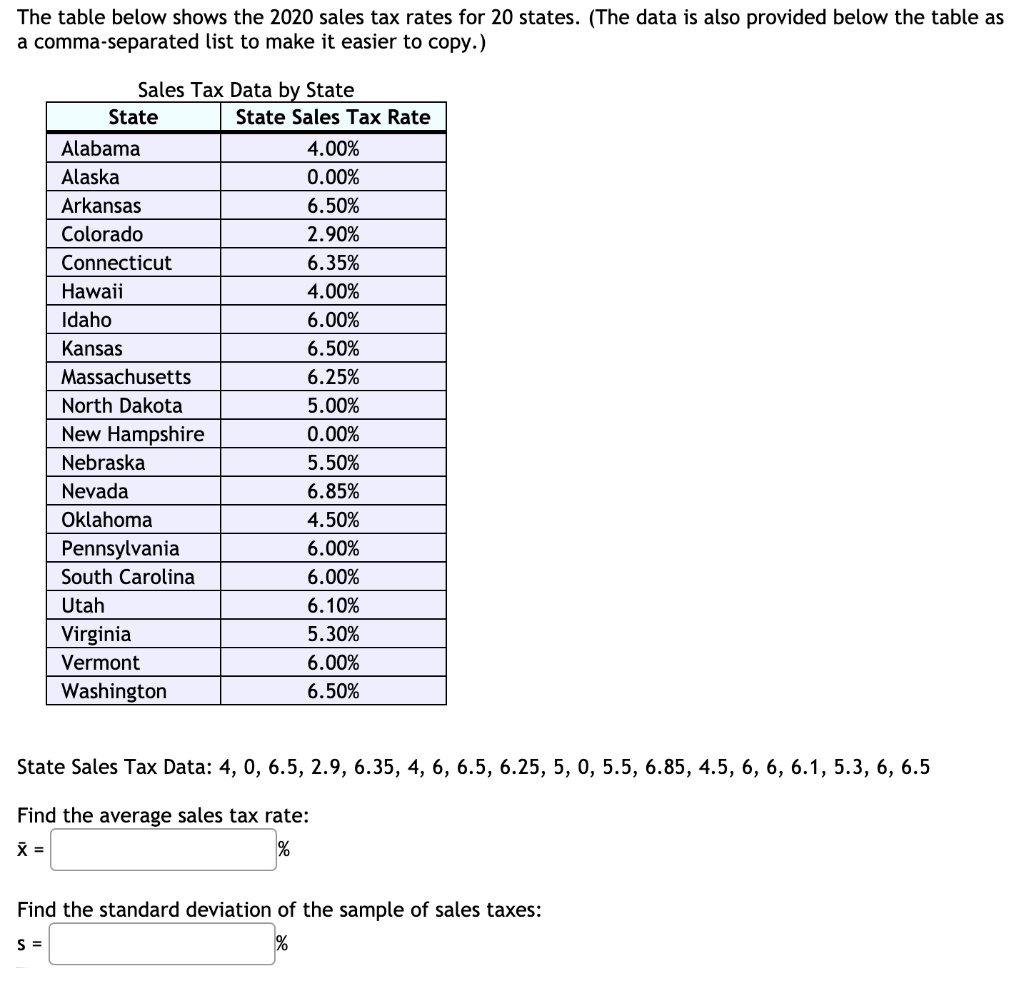

Solved Could You Help Me Figure Out What The Average Sales Chegg Com

Taxes And Spending In Nebraska

Nebraska Income Tax Calculator Smartasset

Nebraska Income Tax Calculator Smartasset

Historical Nebraska Tax Policy Information Ballotpedia

/cloudfront-us-east-1.images.arcpublishing.com/gray/MVMWZY7JTZC5HK6TDJ44RACC34.JPG)

Kansas Food Sales Tax Is 2nd Highest In U S Governor Potential Opponent Support Exemption

State Individual Income Tax Rates And Brackets Tax Foundation

Local Sales Tax Rates Tax Policy Center

Nebraska Sales Tax Guide And Calculator 2022 Taxjar

2021 Sales Tax Rates State Local Sales Tax By State Tax Foundation

Nebraska Tax Rates Rankings Nebraska State Taxes Tax Foundation